- GlobalNetwork

-

- Global Site

- Americas

-

- United States

Information Disclosure Based on TCFD Recommendations/ Efforts to address climate change

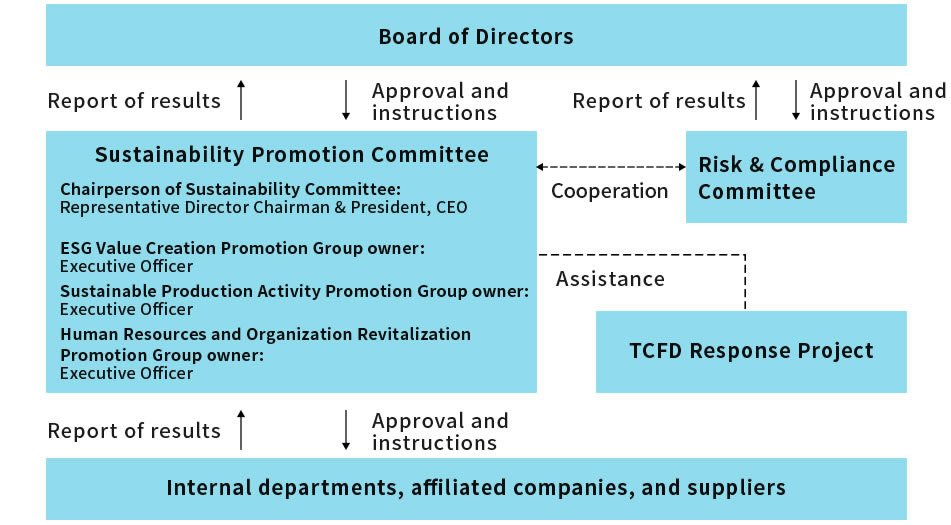

We have supported the Recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). In addition, we promote information disclosure with the disclosure framework (governance, strategy, risk management, indicators, and goals for climate-related risks and opportunities) recommended by TCFD.

Governance

We will set up a TCFD response project in order to support the Sustainability Promotion Committee. The project analyzes climate change response scenarios, risks, and opportunities, and then executes response measures. The results will be reported to the Sustainability Promotion Committee.

Matters discussed by the committee will be reported to the Board of Directors for approval and instructions.

The sustainability agenda reported to, approved by, or ordered by the Board of Directors will be communicated to relevant departments and group companies by the Sustainability Promotion Committee. Then, the departments and group companies will reflect the agenda in their management plans and operations. In addition, we will request that our suppliers cooperate with us, depending on the items included in the agenda.

Structure of Sustainability Promotion Committee

Strategy

We have analyzed and assessed the impacts of climate change on our company by 2040, in line with the guidelines recommended by TCFD, utilizing a business environment scenario analysis method.

| Scope | Companies subject to group consolidation |

|---|---|

| Planned period | Present-2040 (For CO₂ reduction, 2050) |

| Scenarios | 1. 1.5°C scenario

The global average temperature rise is kept below 1.5°C above pre-industrial levels References: IEA WEO2020 SDS scenario SSP1-1.9,2.6, WG I report in the IPCC 6th Assessment Report Other 2. 4°C scenario The global average temperature rises about 4°C above pre-industrial levels References: IEA WEO2020 STEPS scenario SSP2-4.5, SSP3-7.9, and SSP5-8.5, WG I report in the IPCC 6th Assessment Report A-PLAT S8 Climate RCP8.5 Other |

WEO: IEA's World Energy Outlook 2020

IPCC: Intergovernmental Panel on Climate Change

A-PLAT: Climate Change Adaptation Information Platform

To identify climate change risks and opportunities in a more specific manner, we have forecast changes in

our business environments under the 1.5°C and 4°C scenarios and then identified possible risks and

opportunities.

Of those, shown in the table below are the ones that can have major impacts on our management.

Our scenario analysis indicated that some part of our operations can be affected by social and market

changes associated with climate change, while there are also considerable business opportunities, such as

expansion of renewable energy product markets.

To achieve sustainable management and to grow, we need to act promptly, forecasting accurately how our

business environments will change. We are currently studying possible measures.

| Principal risks | Emergence timeframe |

Degree of Financial Impact |

|

|---|---|---|---|

| Policies and regulations | Stringent greenhouse gas emission reduction standards will be put in place, necessitating investments and technological improvements in order to reduce emissions. | Short to long term |

- |

| Changes in markets/ customers |

Demand for engine-related products will shrink due to the electrification of automobiles | Medium and long term |

Small |

| Widening adoption of next-generation solar panels will cause demand for products to shrink. | Long term | Small | |

| Changes in the industry, for example in other companies in the same industry |

Competition with competitors will intensify due to a review of the production system in consideration of the changing environment of the industry. | Medium and long term |

Medium |

| Procurement | Disruption in the balance between supply and demand for raw materials (coke and pitch) may cause prices to rise substantially. | Short to long term |

Medium |

| The prices of procured products that comply with the introduction of a carbon tax and other environmental requirements may rise substantially. | Short to long term |

Small | |

| Manufacturing | Costs may increase due to factors such as stoppages in facility operations due to intensifying natural disasters. | Medium and long term |

Small |

| The cost of manufacturing process improvements required in order to comply with environmental requirements will rise. | Medium and long term |

Medium | |

| Principal opportunities | Emergence timeframe | Degree of Financial Impact | |

|---|---|---|---|

| Policies and regulations |

Demand for environmentrelated products such as renewable energy may rise. | Medium and long term |

- |

| Changes in markets/ customers |

Demand for graphite parts and materials, for example products related to power semiconductors, will rise as a result of the electrification of automobiles. | Medium and long term |

Large |

| Demand for power supply and earthing brushes increases due to an increase in demand for wind power generation. | Medium and long term |

Small | |

| Demand for graphite for use in nuclear power applications may rise as CO₂ emissions are reduced. | Medium and long term |

Small | |

[Financial Impact] Small: Less than 1 billion yen ; Medium: More than 1 billion yen to less than 10 billion yen ; Large: More than 10 billion yen

Risk management

Our group has the Risk & Compliance Committee (RC Committee) in place as the governing body for

compliance with laws

and regulations, our articles of incorporation, and corporate ethics, and to establish a risk management

system. The

committee discusses matters important in terms of risk and compliance, and then determines policies.

Individual risks are

controlled and addressed by responsible departments under the RC Committee's supervision.

Climate risk items are managed by the Sustainability Promotion Committee and are assessed and reviewed by the RC Committee as part of company-wide risk management. The results are reported to the Board of Directors.

Metrics and targets

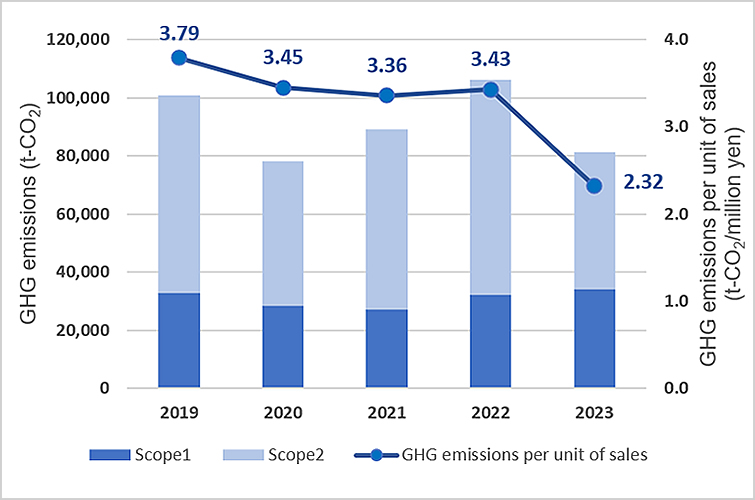

Toyo Tanso is accelerating its programs for the reduction of greenhouse gas emissions, aiming to become carbon neutral by 2050.

The greenhouse gas emissions in the past years in Scope1, Scope2 and Scope3 were calculated in accordance with the GHG protocols.

FY2030 Targets

Greenhouse gas emissions per unit of sales (Scope1, Scope2 ) 30% reduction compared to FY2019 (Non-consolidated)

Greenhouse gas emissions chart (Scope1 + Scope2 : Non-consolidated)

Third party verification of greenhouse gas emissions.

We received third-party verification of greenhouse gas emissions covering operations and activities of the company to further improve transparency in method of calculation and scope in data collection for key sustainability indicators.

Report on greenhouse gas emissions

- [GHG emissions data]

- period:1 January 2024 to 31 December 2024

- [GHG emissions]

-

Scope1(Consolidated) :

37,608 t-CO2e

- Scope2(Consolidated) : location-based 76,135 t-CO2e,

market-based 53,967 t-CO2e- Scope3(Non-consolidated): 98,134 t-CO2e

- Breakdown(t-CO2e)

- Category1: 55,694

- Category2: 20,077

- Category3: 16,742

- Category4: 4,275

- Category5: 561

- Category6: 148

- Category7: 454

- Category13: 84

- Category15: 98

We will set metrics and targets for risk and business opportunity management after adopting response measures for each risk and opportunity.

Efforts to address climate change

We recognize that climate change is a serious issue that will affect society in the future.

All of our employees strive to raise awareness of environmental maintenance by working to improve the efficiency and reduce energy use in manufacturing processes to reduce greenhouse gas emissions such as CO₂.

In addition, based on the basic concept of ISO14001, an international standard for environmental management, we comply with various environmental laws and regulations in each country, and thoroughly engage in resource conservation activities and management of environmental pollutants by reducing industrial waste.

As global efforts to address the problem of climate change are accelerating, Toyo Tanso will further reinforce and accelerate its programs for greenhouse gas emissions, aiming to become carbon neutral in 2050.

Regarding Scope 1, Scope 2 and Scope 3, we are now carrying out calculations that conform to GHG protocols.

- 1.Introduction of energy-saving equipment

- 2.Introduction of energy sources with low CO₂ emission coefficients

- 3.Changing to baking furnaces with low energy consumption rates

- 4.Optimizing furnace operating times

- 5.Optimizing furnace loading efficiency

- 1.Changing to renewable energy

- 2.Increasing solar power generation

- 3.Introduction of energy-saving equipment

- 4.Introduction of electric vehicles

- 5.Reducing energy consumption in manufacturing

Assessment results of the climate change category in the CDP

-

- We have earned a "B" in the climate change category in the CDP 2025 rating.

CDP is a UK-based international environmental non-governmental organization (NGO) founded in 2000.

The organization compiles and analyzes environmental disclosures collected from companies and municipalities around the world and rates their efforts on an eight-point scale (A, A-, B, B-, C, C-, D, D-).

Our current evaluation, the "B" score, is considered management levels, shows that we has been recognized as a company that is showing some evidence of managing its environmental impact and undertaking actions.